By Tyler Sonderholzer

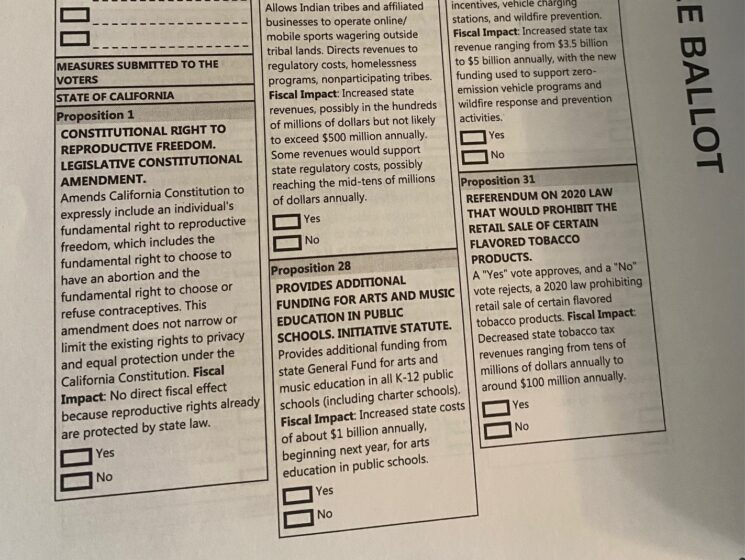

With every California election, voters have the chance to vote on propositions, which are proposed changes to the state Constitution or other laws. Seven propositions will be on the 2022 ballot: Propositions 1, 26, 27, 28, 29, 30 and 31.

There are four types of propositions on the ballot, legislatively referred constitutional amendments (LRCA), combined initiated constitutional amendments and state statutes (CICA/SS), veto referendums (VR) and initiated state statutes (CISS). All propositions, regardless of type, need only a simple majority to pass.

LRCA propositions appear on the ballot when a proposed constitutional amendment is approved by a two-thirds vote in both chambers of the state legislature. Voters will vote on whether or not to ratify the amendment. Proposition 1 is the only LRCA proposition on the ballot.

CISS are citizen-initiated ballot measures that amend state law. Propositions 28, 29 and 30 are three CISS propositions.

CICA/SS are combined initiated constitutional amendments with initiated state statutes (state laws). If approved, it will change both the state constitution and one or more state statutes. There are two CICA/SS propositions on the ballot, Propositions 26 and 27.

VR are citizen-initiated measures that ask voters to uphold or repeal a specific law passed by the state legislature. A yes vote means the voters approve the legislation and want it to become law. Only one proposition falls under the VR category: Proposition 31.

There are seven propositions on the ballot on topics such as abortion, sports gambling, arts and music funding and the environment.

If passed, Proposition 1 will change the California Constitution so that the state cannot deny or interfere with a person’s reproductive rights. A “Yes” vote on the measure means that the state constitution would specifically include the right to choose whether or not to have an abortion and the use of contraceptives. Meanwhile, a “No” vote means that the state constitution would not include these rights; however, they would continue to exist under state law.

There would be no direct fiscal impact as these rights are already protected by state law.

Supporters say that the proposition will ensure that the right to abortion and contraceptives are protected under the state constitution, making it harder to repeal. Opponents say that this proposal is unnecessary because the right to abortion and contraceptives are already law. They also argue that the potential court battles would cost the state millions of dollars.

Proposition 1 is highly likely to pass considering polling and the state’s overwhelming Democratic voter registration.

Proposition 26 allows tribal casinos and horse race tracks to allow in-person sports betting. Betting at race tracks would only be offered to those over the age of 21 while the age at tribal casinos would have to be negotiated by Governor Gavin Newsom and each tribe. Tribal casinos would also be allowed to have roulette and dice games.

Proponents argue that it will generate money for the state and bring more business to the tribal casinos, creating jobs and helping the tribes pay for essential services. Opponents say the new gaming law environment mechanisms could lead to card rooms, places that offer blackjack, poker and other card games but not slots, getting forced out of businesses.

A UC Berkeley poll found that 45% of voters support, 33% oppose and 22% are undecided.

Proposition 27 would allow tribes and gaming companies to offer online sports betting for those 21 and over. It would also create a new division in the state’s Justice Department to monitor online sports betting. Tribes and gaming companies would have to pay fees and taxes, giving hundreds of millions of dollars to the state, and 85% of that money would address homelessness and gaming addiction programs while the rest would go to tribes that do not offer sports betting.

Those who support the proposition say that it would create permanent funding to address homelessness and every tribe will be able to benefit, including those who do not offer sports betting. Opponents are concerned that it will drive money away from casinos and the money will go to companies from other states.

Polling indicates that it will not pass as 54% of voters oppose, 34% support and 12% are undecided.

Proposition 28 would require 1%, around $1 billion, of the money guaranteed for public schools and community schools to go to music and arts education. Schools that have a high proportion of low-income households will get more funding and school districts will be required to spend 80% of the new funding on hiring arts and music instructors.

Proponents say that arts and music instruction could help the mental health of young Californians. The arts funding is also expected to generate jobs for teachers. There is no official opposition, political parties, interest groups, etc, to the proposition.

There has not been any major polling for Proposition 28.

Proposition 29 would require kidney dialysis clinics to have medical professionals on site. Clinics are also required to report infection data and disclose physicians’ who have a 5% ownership interest in a specific clinic. It also prohibits clinics from closing without state approval.

Supporters say that dialysis patients will receive safer treatment with a physician on board. They also say that the reporting requirements would help increase transparency. Opponents argue that clinics report infection data to the federal government and see it as unnecessary as clinics provide the quality care and staff needed to treat people.

There has been no major polling for Proposition 29. However, voters have rejected similar propositions in 2018 and 2020.

Proposition 30 would implement a 1.75% personal income tax increase on those who make over $2 million dollars a year. The generated tax revenue, potentially $3.5 billion to $5 billion, would be used to subsidize zero-emission vehicles and fund wildfire response and protection. 80% of that money would go to rebates for those who buy zero-emission cars and funding to build more charging stations. The rest of the money would be allocated to hiring and training firefighters.

The tax would go into effect in January 2023.

Proponents argue that the tax revenue would aid the transition to electric vehicles, boost the electric vehicle charging infrastructure and give more resources to firefighters to combat wildfires. Opponents argue that the tax is unnecessary due to most Californians facing the effect of high inflation and increasing gas prices. They also say that residents already pay some of the highest personal income taxes and the proposed tax would drive residents out of the state.

According to polling, Proposition 30 will pass with 55% of voters supporting it, 40% against the proposition and 5% undecided.

Proposition 31 is a referendum where the voters decide whether to overturn a 2020 law that prohibits the sale of flavored tobacco products. Voting “yes” will uphold the law while voting “no” would strike down the law. If the law is upheld, the state will see a decrease in state tobacco tax revenue by tens of millions to $100 million every year.

Supporters say the law protects kids by prohibiting the sale of candy-flavored tobacco as 80% of kids who have used tobacco started with a flavored tobacco product. They also argue that it will help lower smoking rates. Opponents say that the ban is not needed as there are already existing laws that block the sale of all tobacco to minors and it infringes on the rights of adults who use flavored tobacco products. They also say that prohibiting the sale of these products would lead to more crime and increase underground markets.

There has been no major polling for Proposition 31.

How to vote

Some of the propositions will pass while others will be defeated, and the outcome of the propositions rests in the hands of the voters. These propositions can have a major effect on the lives of Californians so it is important that people vote. Voters can vote by mail, in person on election day or through early voting.